In an era where 90% of startups fail, venture studios are rewriting the rules of innovation by building companies from the ground up.

Unlike traditional VCs or accelerators, these hands-on factories blend equity stakes, repeatable playbooks, and in-house expertise to accelerate success.

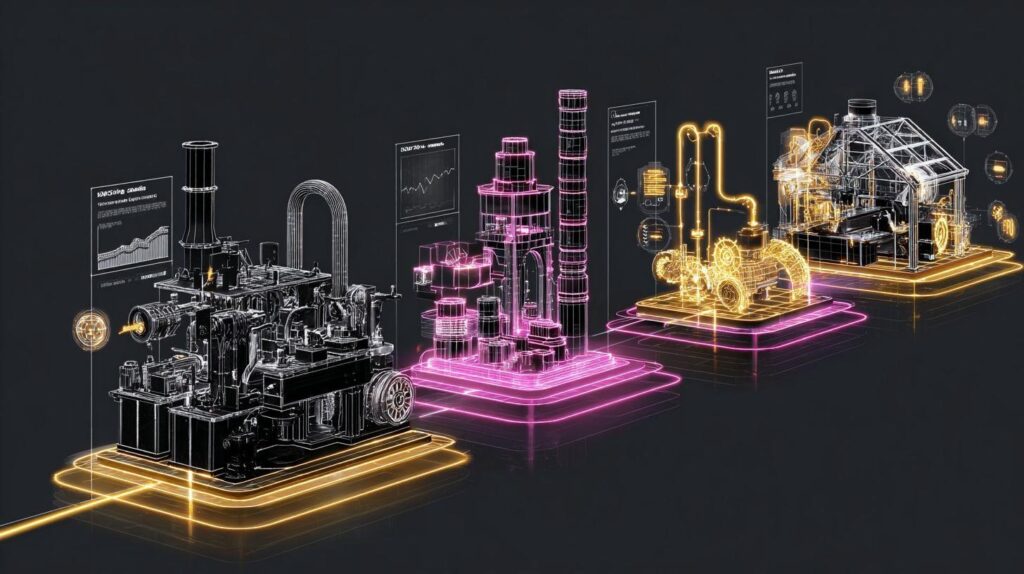

Discover their evolution-from Idealab’s 1996 origins through AI-driven phases to future decentralized models-and why they’re the new standard for founders.

Definition and Core Concept

A venture studio is an operational entity that ideates, validates, builds, and scales 3-10 startups annually using shared resources and repeatable processes. This startup factory model differs from traditional venture capital by handling hands-on execution. It reduces risks through structured venture building.

The core framework starts with idea generation using AI tools and market scans to spot trends in sectors like SaaS or fintech. Next comes MVP build in 4-6 weeks with no-code platforms for rapid prototyping. This lean approach ensures quick idea validation before heavy investment.

Team assembly combines studio operators with external founders or co-founders, fostering diverse founder teams. Equity splits typically give the studio 20-40% and founders 20-30%, aligning incentives for scaling businesses. Studios provide operational support like legal frameworks and tech stacks from day one.

CB Insights data shows these studios achieve a 25% higher survival rate versus traditional startups due to shared services and expertise. Examples include Pioneer Square Labs and eFounders, which apply agile methodology across portfolio companies. This innovation model boosts product-market fit through customer discovery and iterative development.

Distinction from Traditional VCs and Accelerators

Unlike VCs who invest $500K-$5M for 10-20% equity post-pitch, venture studios build from scratch owning 30%+ equity with zero external capital raise. This hands-on approach sets studios apart in the evolution of venture building. Founders benefit from operational control without the pressure of early fundraising.

Traditional VC firms provide passive capital after rigorous due diligence. They focus on scaling existing startups through portfolio companies. In contrast, studios act as a startup factory, handling everything from ideation to MVP development.

Accelerators offer short programs with seed funding and mentorship. They emphasize demo days for investor exposure. Studios, however, maintain deeper involvement across the startup lifecycle, including product development and go-to-market strategies.

Real-world examples highlight these differences. a16z as a VC invests in pitched ideas like fintech and AI startups. Pioneer Square Labs, a venture studio, builds companies in-house, such as software tools, retaining significant equity and control.

| Aspect | VCs | Accelerators | Venture Studios |

| Investment Approach | Passive capital post-diligence | Fixed program funding | In-house build from scratch |

| Timeline | 90-day diligence | 3-month programs | Ongoing operational support |

| Equity Stake | 10-20% | 7% for $120K | 30%+ with control |

| Focus | Scaling pitched startups | Demo day exposure | Idea validation to scaling |

| Example | a16z (invests in SaaS, healthtech) | Y Combinator, Techstars | Pioneer Square Labs (builds edtech tools) |

This side-by-side comparison shows how studios reduce risk through active involvement. They enable rapid prototyping and founder teams without external dependencies. The studio model appeals to serial entrepreneurs seeking a new way to build.

Historical Origins

Venture studios trace roots to 1970s corporate venturing but crystallized with Idealab’s 1996 model that launched 75+ companies. This startup factory approach evolved from internal innovation labs to structured venture building entities. Early phases featured corporate R&D spinouts, while modern studios emphasize idea validation and rapid prototyping.

The timeline shows a shift from isolated intrapreneurship efforts to repeatable studio models. Idealab’s success, with exits exceeding $7 billion, highlighted the power of serial entrepreneurship and portfolio companies. This previewed evolutionary phases like lean startup integration and co-founder matching.

From corporate venturing to today’s hybrid models, studios now offer operational support in product development and scaling. They bridge gaps in traditional venture capital by capturing equity in multiple ventures. This foundation set the stage for innovation hubs focused on product-market fit.

Key learnings include fail-fast philosophy and shared services for tech stack and legal support. Studios enable parallel building of startups, improving hit rates through cross-pollination. The evolution continues with AI-powered tools and global expansion.

Early Precursors in Corporate Venturing

Xerox PARC (1970) birthed GUI, Ethernet, and laser printing, foreshadowing studio model without capturing internal value. These innovation labs generated breakthroughs but often lost control to spinouts. The pattern repeated across industries, showing limits of business incubation without equity stakes.

Other examples include:

- Bell Labs inventing the transistor in 1947, powering modern computing yet spinning out value externally.

- Sony’s Betamax labs in 1975, pioneering video tech but failing to dominate markets.

- 3M’s 15% rule leading to Post-It notes in 1980, encouraging intrapreneurship with loose time for ideas.

This era revealed a core flaw: internal innovation fueled spinouts, but companies rarely retained meaningful equity. Experts recommend structured venture studio approaches to address this. Corporate venturing laid groundwork for modern startup creation.

Lessons from these precursors emphasize idea validation and market fit early. Without capture mechanisms, value leaked to agile outsiders. This drove the need for dedicated startup factories with skin in the game.

Idealab and the First Modern Studio (1996)

Bill Gross’s Idealab launched in 1996, creating 75 companies including Overture with exits to Yahoo and Google. This venture studio acted as an idea factory, investing $250K seed into promising concepts before spinout. It pioneered the studio model by handling product development and go-to-market.

The process involved rapid prototyping of MVPs, followed by lean startup tactics like customer discovery. Idealab achieved higher success rates than traditional VC by reusing IP and failing fast. Key learnings included building diverse portfolio companies for diversified bets.

Gross noted, Build 10 companies, 1 becomes unicorn, capturing the fail-fast philosophy. Archived BusinessWeek coverage praised its serial entrepreneurship and operational edge. Studios like this offered founder teams tech stack support and agile methodology.

Idealab’s model influenced venture building with shared services in HR, finance, and marketing. It improved hit rates through iterative development and user feedback. This blueprint shaped later studios focused on scaling businesses and exit strategies.

Key Evolutionary Phases

Venture studios evolved through 3 phases: 1990s incubation with Idealab, 2010s expansion seen in eFounders and Rocket Internet, and 2020s platform maturity driven by AI and no-code tools. Assets under management grew from $100M in 2000 to over $50B by 2024, reflecting the venture studio evolution toward scalable startup creation. Portfolio success rates improved across phases as studios refined their startup factory models.

Phase 1 focused on founder-centric incubation during the dot-com boom. Phase 2 emphasized market expansion and playbook replication in the tech boom. Phase 3 integrates AI for rapid prototyping and global talent pools.

These stages highlight a shift from basic business incubation to sophisticated venture building. Studios now offer operational support, from idea validation to scaling businesses. This progression boosts success probability through diversified bets and hands-on guidance.

Understanding these phases helps entrepreneurs grasp the new way to build startups. Studios provide co-founder matching, tech stacks, and go-to-market strategies that traditional VC firms overlook.

Phase 1: The Incubation Era (1990s-2000s)

Idealab (1996-2002) defined Phase 1, launching 40+ consumer internet startups during dot-com boom with 25% success rate. This venture studio pioneered the incubation model by funding ideas in-house and sharing office space. Founders received $250K internal seed for rapid product development.

Key traits included founder-centric approaches and lean startup principles. Teams focused on MVP creation using early web tech stacks. Examples like Overture led to $1.6B exits amid 75 companies launched and $7B total exits.

The 2001 dot-com crash exposed risks, with 60% failure rate common. Studios learned to prioritize market fit and customer discovery over hype. This era set the foundation for serial entrepreneurship and innovation labs.

Practical lessons endure: emphasize idea validation early and build defensible advantages. Modern founders can apply office-sharing and internal seed tactics to extend runway during bootstrapping.

Phase 2: Tech Boom Expansion (2010s)

Rocket Internet cloned 70+ US successes across emerging markets, reaching $13B valuation by 2014. This phase scaled the studio model through playbook replication and market expansion. eFounders built 25 SaaS companies, including Front at $1.3B valuation.

Betaworks contributed with Giphy’s $400M exit, focusing on rapid prototyping in social tech. Common traits involved growth hacking, agile methodology, and shared services like legal support. Studios achieved faster speed-to-market via repeatable processes.

These players emphasized co-founder matching and operational support for portfolio companies. They replicated successes in fintech and e-commerce platforms, honing go-to-market strategies. This expansion mirrored Y Combinator’s accelerator model but with deeper venture building.

Entrepreneurs today benefit from these tactics: use sales playbooks and metrics dashboards for traction. Focus on unit economics like CAC and LTV to scale B2B SaaS efficiently.

Phase 3: Platform Maturity (2020s)

2020s studios leverage AI like Jasper and no-code tools like Bubble, cutting MVP time from 6 months to 4 weeks. This phase marks platform maturity with AI-powered idea validation and 50% faster processes. Pioneer Square Labs exemplifies with 15 launches and strong funding rates.

Trends include no-code stacks for 10x dev speed and remote global talent acquisition. Studios build remote teams for diversity in founding, targeting women founders and underrepresented entrepreneurs. Crunchbase notes 150+ active studios with $10B+ portfolio value.

Focus shifts to deep tech, climate tech, and AI startups using machine learning for customer discovery. Hybrid models offer shared services in HR frameworks and finance ops. This enables parallel building and hit rate improvement.

Practical advice: adopt A/B testing and user feedback loops for product-market fit. Studios provide equity structures and pitch decks, aiding Series A transitions and ecosystem building.

Core Operational Model

Venture studios operate as startup factories retaining 20-40% equity while providing end-to-end execution. This model prioritizes operational control over capital alone, enabling studios to guide startups from ideation to scaling. Founders benefit from shared services like legal support, software development, and go-to-market strategies.

A typical structure includes 30% studio equity for operations and intellectual property contributions. This aligns incentives, as studios commit sweat equity alongside founders. The approach reduces risks compared to traditional venture capital models.

Key components previewed here cover equity ownership, in-house talent, and repeatable playbooks. These elements form the venture studio evolution, a new way to build startups through structured innovation. Studios like High Alpha exemplify this by supporting multiple portfolio companies efficiently.

This operational model fosters rapid prototyping and product development. It contrasts with accelerators by offering hands-on venture building from day one. Entrepreneurs gain access to proven frameworks for market fit and growth.

Equity Ownership and Skin in the Game

Studios claim 25-40% equity vs VC’s 10-20%, aligning incentives through operational sweat equity. This stake covers operations and IP creation, ensuring studios have skin in the game. Founders retain meaningful ownership while gaining execution support.

A common cap table breaks down as follows: studio at 30% for ops and IP, founders at 25%, employee pool at 20%, and room for future VC at 25%. This structure motivates all parties toward shared success. Term sheets often include clauses like vesting schedules tied to milestones.

For example, High Alpha maintains standard 28% ownership across its companies, balancing control with founder autonomy. LP returns benefit from this model, as studios focus on high-conviction bets. Experts note it enhances overall portfolio performance through active involvement.

Practical term sheet examples include anti-dilution protections for studios and pro-rata rights for founders. This equity structure supports serial entrepreneurship, encouraging repeat founders to partner with studios. It creates a foundation for sustainable scaling and exit strategies.

In-House Talent vs. Contractor Networks

Top studios maintain 20-50 core operators in roles like CTech, design, and product vs pure contractor models. In-house teams enable faster decision-making and consistent quality. This setup supports the full startup lifecycle from ideation to scaling.

In-house models offer advantages in cost savings and speed, as dedicated experts handle multiple projects. High Alpha, for instance, employs full-time equivalents across its startups, streamlining operations. Contractors via platforms like Upwork can slow iteration due to coordination overhead.

Hybrid approaches shine in examples like Antler, with 15 core staff plus 500 mentors. This combines deep operational support with broad network effects. Studios manage bench costs efficiently, avoiding the expenses of fully bootstrapped equivalents.

Practical advice favors in-house for critical functions like software development and customer discovery. Contractors suit niche tasks, but core teams build defensible advantages through shared knowledge. This talent strategy boosts success in venture building and innovation labs.

Repeatable Playbooks and IP Reuse

eFounders’ SaaS playbook templates cut go-to-market time significantly, reused across multiple companies. These repeatable processes standardize startup creation, from idea validation to revenue streams. Studios leverage them to accelerate the path to product-market fit.

Key playbooks include:

- Customer discovery with interview templates for rapid insights.

- MVP spec using shared Figma libraries for quick prototyping.

- Sales playbook with Outreach sequences for efficient user acquisition.

- OKR framework in collaborative docs for tracking progress.

- Exit checklist outlining steps for acquisition or IPO readiness.

IP reuse examples include Rocket Internet’s logistics stack deployed across markets, enabling 3x faster scaling. This creates proprietary technology and white-label solutions. Studios cross-pollinate learnings, enhancing portfolio company performance.

Actionable steps involve adapting these playbooks to sectors like fintech or healthtech. They support agile methodology and iterative development, reducing burn rate. This IP generation defines the studio model as a true startup factory.

Strategic Advantages

Venture studios offer a new way to build startups by combining hands-on operational support with rapid execution. CB Insights data shows studio portfolio companies raise external capital 40% faster than traditional startups. This edge comes from structured processes that speed up every stage of startup creation.

Studios achieve 3x faster time-to-MVP and 2.5x better capital efficiency versus bootstrapping. They provide shared resources like design tools and developer teams, cutting solo founder struggles. Key advantages include quicker market entry, lower costs, and higher success odds through diversified portfolios.

Portfolio companies benefit from serial entrepreneurship expertise and cross-pollination of ideas. Studios run multiple projects in parallel, spreading risk while building repeatable playbooks for product development. This innovation model turns idea validation into scalable businesses faster than accelerators or VC firms.

Experts recommend studios for founders seeking operational support in go-to-market and scaling. Real-world examples like High Alpha and eFounders highlight how shared services boost traction metrics and runway extension. Overall, the studio model enhances product-market fit and investor appeal.

Speed to Market and Iteration

Studio-built MVPs launch in 28 days versus 90+ for traditional founders, per Antler data. This speed stems from streamlined ideation to launch cycles using rapid prototyping. Teams focus on core features first, avoiding common delays in software development.

Breakdown includes ideation in 3 days, MVP in 3 weeks, and first 100 users in 2 weeks. Tools like Figma for design, Bubble for no-code builds, and Posthog for analytics enable quick progress. These choices fit lean startup principles from experts like Eric Ries.

- Weekly OKRs keep teams aligned on priorities.

- 48-hour pivots allow fast adjustments based on user feedback.

- Agile methodology drives iterative development and A/B testing.

High Alpha’s Finmark reached key milestones swiftly, showing the power of this approach. Studios excel in pivot strategy and customer discovery, helping startups achieve early market fit. This venture building method suits AI startups, fintech, and SaaS products aiming for quick validation.

Resource Efficiency Over Bootstrapping

Shared services cut burn rate 60%: $8K per month per startup versus $20K for solo founders. Studios pool costs across portfolio companies, maximizing every dollar. This efficiency supports longer runways without heavy reliance on seed funding.

ROI improves with lower CAC at $45 versus $120 for bootstrapped ventures, lifting LTV/CAC ratios. Shared assets include legal templates saving $5K per deal, dev benches at $120 per hour, and Hubspot for marketing. These reduce unit economics pain points like high churn.

- HR frameworks speed talent acquisition and co-founder matching.

- Finance ops handle cap tables and term sheets expertly.

- Sales playbooks and customer success metrics drive retention.

eFounders’ Front saved $1.2M before Series A through such efficiencies. Bootstrappers often face isolation, while studios offer startup factory support for growth hacking and monetization. This model fits B2B SaaS and marketplace models needing scalable tech stacks.

Diversified Risk Across Portfolio

The studio model hits higher success rates by running 8-12 parallel bets annually versus traditional VC approaches. Diversification spreads risk across sectors like 40% SaaS, 30% fintech, 20% consumer, and 10% deep tech. This portfolio math aims for outsized returns from a few winners.

With 10 startups at 30% equity each targeting 10x multiples, funds see strong potential. Failures get offset by hits, as with Betaworks where Giphy’s $400M exit covered many losses. Parallel building, noted in Harvard Business Review, improves hit rates through shared learnings.

- Cross-pollination sparks idea validation across teams.

- OKRs and KPIs track traction for timely pivots.

- Network effects build moats via ecosystem orchestration.

Studios mitigate risks better than angel investors or incubators by owning equity stakes. This risk mitigation appeals to LPs seeking value-add investing. Examples like Atomic and Pioneer Square Labs show how diversified bets fuel unicorn potential in climate tech and healthtech.

Modern Innovations Driving Evolution

Tech stack evolution in venture studios enables faster output in startup creation. AI tools cut idea validation from 6 weeks to 10 days, powering Studio 2.0.

Three innovations accelerate growth from 2024 to 2030. These include AI-powered idea generation, no-code/low-code build stacks, and embedded finance integration. Each drives the evolution of the venture studio model.

Studios now build minimum viable products rapidly, validate market fit, and scale businesses with less capital. This new way to build supports founder teams through ideation to seed funding.

Experts recommend combining these tools for rapid prototyping and lean startup principles. The result is higher success rates in the startup lifecycle.

AI-Powered Idea Generation

Perplexity.ai + Claude generate 50 ideas/week scored by PMF potential including demand, competition, and moat. This stack handles market scans and business model canvases efficiently.

Tool stack includes Perplexity for market scans, Claude for business model canvas, and Composio for workflow automation. The process filters 100 ideas to 20 validated, then 5 MVPs.

Pioneer Square Labs used GPT-4 to identify 3 edtech opportunities, with 2 funded. This approach speeds idea validation in the venture studio model.

Studios apply this for product development across sectors like healthtech and climate tech. It supports serial entrepreneurship by automating early stages of startup creation.

No-Code/Low-Code Build Stacks

Bubble + Supabase stack builds SaaS MVPs in 14 days vs 90+ traditional dev. This enables rapid prototyping without large engineering teams.

| Tool | Pricing | Use Case |

| Bubble | $25-500/mo | Drag-drop apps |

| Webflow | $14-49/mo | Marketing sites |

| Airtable | $10/user | Ops management |

| Zapier | $20/mo | Automation |

Studio stack pairs Bubble + Stripe + Posthog for full MVPs. Antler built a fintech MVP in 10 days using this method.

These tools cut costs and time in venture building. They fit the studio model for parallel startup factory operations.

Embedded Finance Integration

Stripe Issuing + Treasury enable Day 1 revenue: $2K embedded payments in Week 3 MVP. This speeds monetization in early product development.

Tech includes Stripe for payments, Plaid for connections, and Ramp for corporate cards. High Alpha portfolio co issued virtual cards by Day 15, hitting $50K revenue by Month 3.

Integration boosts go-to-market with revenue streams from launch. Studios ensure FinCEN compliance using templates for regulatory hurdles.

This fits fintech and beyond in the startup factory approach. It raises LTV through embedded finance in portfolio companies.

Case Studies of Leading Studios

Real-world examples from top venture studios show how this innovation model drives startup creation. Leading performers like High Alpha and Antler demonstrate repeatable processes in venture building. Their approaches offer proof points on co-founder matching, rapid prototyping, and scaling businesses.

High Alpha focuses on B2B fintech with a structured playbook for idea validation and market fit. Antler uses a global residency for MVP development and founder teams. These cases highlight the studio model advantages in operational support and portfolio outcomes.

Lessons from these startup factories include vertical specialization and talent acquisition strategies. They emphasize lean startup methods, customer discovery, and go-to-market execution. Founders benefit from shared services like legal support and sales playbooks.

High Alpha: Fintech Focus

High Alpha launched 25 fintech/SaaS companies since 2017, with 18 raising $200M+ VC. Based in Indianapolis, this venture studio follows a B2B fintech playbook from ideation to Series A. Their team of 40 operators supports portfolio companies with hands-on venture building.

The studio’s process starts with customer discovery and rapid prototyping, moving to product development and go-to-market. Key metrics include strong portfolio ARR and a high Series A rate. An exit like OppFi on NASDAQ shows success in scaling businesses.

Vertical specialization in fintech leads to better outcomes through focused expertise. A founder notes, “High Alpha’s operators acted as our first employees, accelerating our path to product-market fit.” Their cap table example often features equity structures with studio taking 40-50% for active involvement.

- Ideation phase: Market research and idea validation.

- Execution: Agile methodology for MVP and tech stack.

- Scaling phase: Growth hacking and seed funding prep.

Antler: Global Early-Stage Builder

Antler operates in 25 cities, building 500+ startups with $1.5B portfolio value. This global venture studio uses a residency model for co-founder matching and MVP creation. Founders spend four weeks building teams and prototypes with operational support.

Their key innovation is a matching algorithm from a global talent pool, aiding diverse founder teams. Many companies raise external capital soon after, with averages around $750K per company. Geographies include strong presence in Asia and Europe for ecosystem building.

Antler’s approach covers the full startup lifecycle, from validation stage to pitch decks and investor syndicates. They provide shared services in software development and design thinking. Lessons focus on pivot strategy and user acquisition for early traction.

- Week 1-2: Co-founder matching and idea validation.

- Week 3-4: MVP build with rapid prototyping.

- Post-residency: Term sheets, due diligence, and bridge financing.

Future Trends and Challenges

By 2030, AI tools and no-code platforms will enable 10x startup output in venture studios, but they will face Web3 regulation and ESG mandates. This forward-looking view of Studio 3.0 highlights tensions between massive opportunities in rapid prototyping and execution hurdles like compliance costs. Venture studios must balance innovation with sustainable practices to thrive.

Decentralized models promise global founder teams through token incentives, yet governance issues loom large. Regulatory pressures from securities laws add complexity to blockchain ventures. Studios adapting to these shifts will lead the evolution of startup creation.

ESG mandates push for impact-focused portfolio companies, raising questions on measurement and authenticity. Experts recommend integrating impact metrics early in the startup lifecycle. This preview sets the stage for key challenges ahead.

Hybrid models blending AI-powered studios with human oversight offer a path forward. Operational support in product development and market fit remains crucial. Studios that navigate these trends will define the future of venture building.

Decentralized/Autonomous Studios

DAOs like MetaCartel Studios launched 15 web3 projects using quadratic funding. These decentralized studios represent an emerging model in the venture studio evolution. They enable community-driven startup creation without traditional hierarchies.

Key features include DAOs with shared treasuries, token incentives for builders, and smart contract IP via templates like OpenZeppelin. Builders receive rewards from treasury allocations, fostering serial entrepreneurship. This approach accelerates ideation and MVP development.

- Quadratic funding democratizes seed funding decisions.

- Token models align incentives for founder teams and contributors.

- Smart contracts automate equity structures and cap tables.

Challenges persist in governance, such as voter apathy, and legal wrappers like DAO LLCs. Studios can mitigate risks with clear legal playbooks. Prediction points to growing adoption in the innovation model.

Regulatory Hurdles in Web3 Era

SEC’s Howey Test classifications hit many crypto studios; EU’s MiCA adds compliance timelines. These regulatory hurdles challenge blockchain ventures in the Web3 era. Venture studios must adapt to protect portfolio companies.

Key issues include unregistered securities cases like pump.fun, MiCA stablecoin licensing since July 2024, and upcoming GDPR AI Act in 2026. Compliance demands due diligence on token launches and data handling. Experts recommend early legal audits.

- Form Wyoming DAO LLCs for simple entity structures.

- Use legal playbooks from firms like Cooley for term sheets.

- Budget for ongoing costs in cybersecurity and GDPR compliance.

Solutions focus on wrappers and playbooks to ease startup lifecycle navigation. Annual compliance efforts help maintain investor trust. Studios prioritizing this will sustain growth in fintech and deep tech.

Sustainability and Impact Mandates

LPs now require ESG screening; climate tech allocation has surged. These sustainability mandates reshape venture studios toward impact ventures. Studios must integrate ESG from ideation to scaling.

Breakdown includes B Corp certification for premium valuations, carbon accounting tools like Normative, and DEI focus on women founders. Adaptations appear in studios like Obvious Ventures for impact only and Lowercarbon for climate tech. This builds defensible advantages in competitive markets.

- Pursue B Corp for credibility with value-add investors.

- Track carbon footprints to meet LP expectations.

- Prioritize diverse founder teams for broader market fit.

Impact studios emphasize metrics like survival rates through strong unit economics. Practical steps involve OKRs tied to ESG goals. This evolution supports sustainable startups in healthtech and edtech.

Frequently Asked Questions

What is “The Evolution of the Venture Studio: A New Way to Build”?

The Evolution of the Venture Studio: A New Way to Build refers to the transformation of venture studios into modern innovation engines that actively co-create startups, combining the hands-on building expertise of product studios with the scaling power of traditional venture capital.

How has the venture studio model evolved over time?

In The Evolution of the Venture Studio: A New Way to Build, the model has shifted from passive investing to proactive company building, incorporating lean startup methodologies, rapid prototyping, and integrated design teams to de-risk early-stage ventures more effectively.

What makes the venture studio a “New Way to Build” startups?

The Evolution of the Venture Studio: A New Way to Build emphasizes an in-house approach where studios provide not just funding but also talent, technology, and operational support, enabling faster iteration and higher success rates compared to traditional incubators.

Why is understanding The Evolution of the Venture Studio: A New Way to Build important for entrepreneurs?

Grasping The Evolution of the Venture Studio: A New Way to Build helps entrepreneurs partner with studios that offer end-to-end support, from idea validation to market launch, reducing common pitfalls like founder burnout and product-market mismatch.

What are the key benefits of the evolved venture studio model in “The Evolution of the Venture Studio: A New Way to Build”?

Key benefits in The Evolution of the Venture Studio: A New Way to Build include shared risk through equity stakes, access to specialized expertise, and a structured process for building scalable businesses, often leading to quicker paths to revenue and investment.

How does The Evolution of the Venture Studio: A New Way to Build differ from traditional VC funding?

Unlike traditional VC which provides capital post-validation, The Evolution of the Venture Studio: A New Way to Build involves studios building the company from scratch, owning equity upfront and mitigating risks through active involvement in development and go-to-market strategies.