The global financial landscape is hurtling toward a future characterized by autonomy, decentralization, and hyper-personalization. Experts predict that the next decade, particularly leading up to 2035, will witness a profound, irreversible restructuring of the industry, driven not just by technology, but by evolving consumer trust and the relentless pursuit of efficiency. The traditional walls separating banking, asset management, and even insurance are dissolving, replaced by an integrated, data-driven ecosystem.

This structural overhaul is primarily powered by three colossal technological forces: the maturation and mass implementation of Artificial Intelligence (AI), the continued evolution of Blockchain and Distributed Ledger Technology (DLT), and the urgent need for digital-first, agile operational models to replace aging legacy systems.

The AI Revolution: From Automation to Autonomy

The most transformative factor cited by experts is the mass adoption of AI, which is moving beyond simple process automation to become the core intelligence layer of financial services. The consensus among financial leaders is that AI is poised to save the banking industry an estimated $1 trillion by 2030 through cost reduction and enhanced revenue generation.

Cognitive Financial Agents and Hyper-Personalization

Experts anticipate the rise of Cognitive Financial Agents—sophisticated AI systems capable of operating independently to manage and optimize a client’s entire financial life. These agents will move past basic robo-advising to provide truly holistic services:

Real-time Risk Management: AI models will analyze market shifts, individual spending patterns, and macroeconomic indicators in real-time, adjusting portfolios, credit limits, and insurance coverage instantly. For institutions, this means Early Warning Systems for credit risk and automated, high-frequency stress testing for market volatility.

Hyper-Personalized Products: AI will identify niche, unmet needs within the customer base and automatically generate new financial products tailored to specific client segments. This leads to emergent products that evolve based on usage, fundamentally disrupting the slow, high-cost cycle of traditional product development.

Automated Compliance and Fraud: AI is already a primary defense against financial crime, flagging anomalous transactions and strengthening security. By 2030, this role will expand into Regulatory Compliance Automation, where rules are embedded directly into smart systems, monitoring and ensuring adherence across multiple global jurisdictions in real-time, drastically reducing the $83.5 billion spent annually on AML compliance.

The Challenge of Algorithmic Bias

Despite the immense promise, the experts caution that the acceleration of AI carries significant risk. The widespread use of deep learning models amplifies concerns regarding algorithmic bias where historical data containing societal prejudices can lead to unfair lending decisions or unequal financial access. Addressing this, alongside issues of data privacy and the need for Explainable AI (XAI) in regulatory oversight, will be a defining ethical challenge for the finance sector throughout the decade.

Blockchain and Decentralization: The New Plumbing

While the initial hype around public cryptocurrencies has moderated, the underlying Distributed Ledger Technology (DLT), or blockchain, is quietly establishing itself as the new, foundational infrastructure for institutional finance. The focus has shifted from retail investment to wholesale efficiency and the tokenization of traditional assets.

Cross-Border Payments and Securities Settlement

One of the most immediate and impactful use cases is the transformation of cross-border payments. Traditional correspondent banking is slow, opaque, and expensive. DLT allows banks to bypass multiple intermediaries, facilitating near-frictionless, real-time settlement 24/7, significantly reducing the billions lost annually to fees and delays.

Tokenization of Assets: Experts predict that by 2038, a significant portion of traditional assets from real estate and private equity to fractional shares of fine art will be tokenized on private, regulated blockchains. This fractionalization and digitization of ownership will unlock massive liquidity for illiquid assets, streamline custody, and drastically reduce the settlement time for securities from days to seconds (Atomic Settlement).

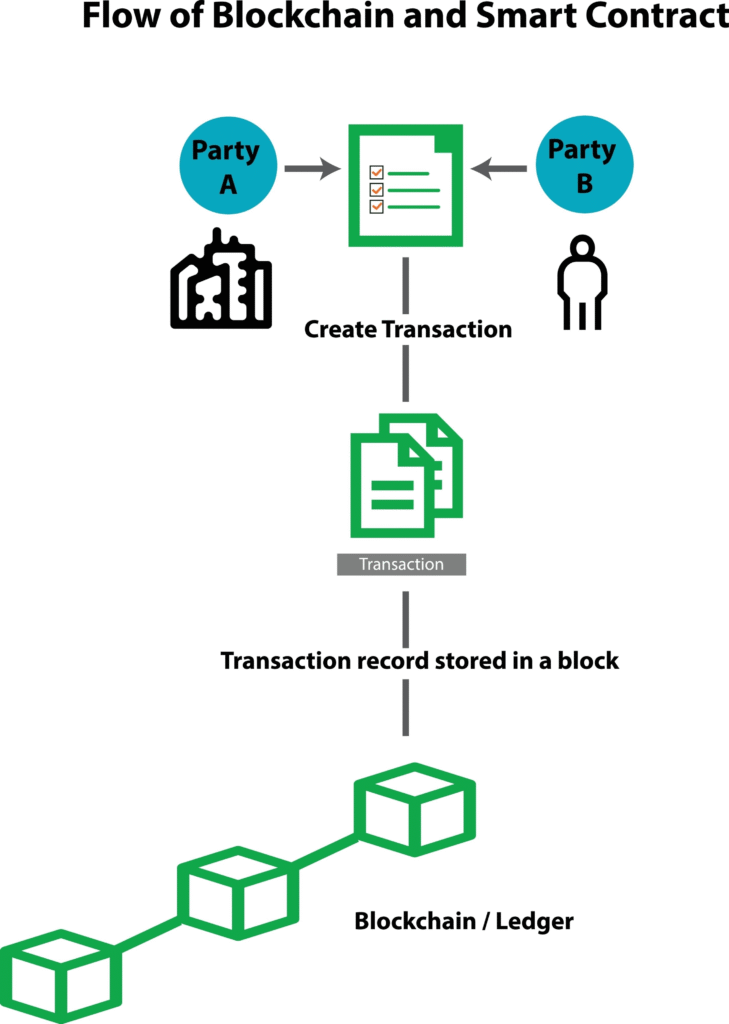

Smart Contracts: Blockchain-based Smart Contracts self-executing agreements with the terms written directly into code will automate complex financial processes. This will be transformative in areas like trade finance, where the verification of documents currently takes weeks, and in insurance, where policy payouts can be triggered automatically upon the verifiable occurrence of an event.

The Decentralized Finance (DeFi) Paradigm

While traditional finance (TradFi) is integrating DLT, the separate ecosystem of Decentralized Finance (DeFi) is concurrently challenging the intermediary model altogether. Powered by smart contracts and Decentralized Autonomous Organizations (DAOs), DeFi platforms offer lending, borrowing, and exchange services without central bank or institutional oversight. Experts forecast that while DeFi adoption remains niche, its underlying principles of transparency, peer-to-peer execution, and low-cost structure will force traditional banks to continuously lower fees and increase transaction speed to remain competitive.

The Fate of Traditional Banking: The Platform Imperative

Traditional banks face a precarious future defined by two immense challenges: outdated legacy technology systems and aggressive competition from FinTechs and non-bank players.

The Legacy Burden

The Achilles’ heel of incumbent banks is their legacy IT infrastructure complex, decades-old systems that are expensive to maintain, slow to update, and resistant to modern cloud-native architectures. This operational overhead translates directly into higher costs, making it difficult for them to compete with the lean cost structures of digital-only banks (Neobanks).

The Pivot to Platformization

To survive, traditional institutions must undertake front-to-back digitization. The successful banks of the future will cease to be mere providers of accounts and loans and will become Financial Operating Systems open, modular platforms that orchestrate services from various partners. This pivot involves:

Cloud Migration: Moving core banking systems and data processing to the public or private cloud to achieve the necessary agility and scalability.

API Integration: Opening their platforms via Application Programming Interfaces (APIs) to allow third-party FinTechs to plug in specialized services (e.g., budgeting tools, investment analytics), enhancing the customer offering without costly in-house development.

Customer Centricity: Using the integrated data from these platforms to deliver the seamless, intuitive, mobile-first experience that is now standard across all other sectors.

Failure to execute this platform strategy risks having the bank relegated to being a mere balance sheet provider the regulated back-end for more agile consumer-facing competitors.

The Regulatory and Human Dimension

The rapid pace of financial innovation is creating significant challenges for global regulators. The emergence of digital assets, cross-border tokenized securities, and autonomous AI agents necessitates a redefinition of the regulatory perimeter.

Global Harmonization: Experts are calling for a more streamlined, modernized regulatory framework that supports innovation while maintaining risk controls and ensuring consumer protection. The complexity of a global, decentralized market requires greater international cooperation and harmonization of rules like KYC (Know Your Customer) and AML (Anti-Money Laundering).

The Future of Work: As AI and RPA take over repetitive and analytical roles, the banking workforce faces a dramatic transformation. Financial institutions must urgently invest in upskilling and reskilling employees, focusing on roles that manage the AI-human interface, data governance, ethical AI oversight, and complex relationship management. The key to success is fostering a culture of continuous learning and collaboration between human intuition and machine intelligence.

In conclusion, the future of finance is not a gradual evolution, but a tectonic shift. It is a world where financial advice is delivered by an AI agent, where global transfers settle in seconds via DLT, and where a bank’s value is measured less by its physical assets and more by the intelligence and agility of its digital platform. For both incumbents and challengers, the immediate action (2025-2030) is clear: build AI capabilities, master digital asset expertise, and aggressively modernize legacy infrastructure. Those who delay risk permanent obsolescence in the hyper-competitive financial landscape of the 2030s.