In today’s rapidly shifting economic environment, the relationship between risk and reward has become more intricate and unpredictable. Markets move faster than at any time in history, fuelled by digital transformation, global policy shifts and unpredictable geopolitical shifts. What once followed clear patterns now responds instantly to real time data and global sentiment. For businesses, investors and households, understanding how to navigate this landscape is critical. The ability to balance caution with opportunity can shape financial outcomes for years ahead. While uncertainty may appear overwhelming, it also opens doors for innovation, strategic growth and smarter decision making.

Navigating a Landscape of Constant Change

The economic cycle that businesses and consumers grew accustomed to over decades has changed dramatically. Where markets once followed relatively stable patterns, they are now influenced by a much wider set of global forces. Interest rate adjustments, central bank decisions and policy announcements reverberate across borders almost instantly. Supply chain disruptions can emerge unexpectedly from natural events, political disagreements or sudden market demand. Even a shift in consumer preference can alter the direction of entire industries overnight. This interconnectedness means risk can come from angles previously not considered and spread more quickly.

Traditional forecasting tools are struggling to keep pace with this level of speed and complexity. Businesses that once planned yearly or multi year strategies now find themselves revising projections more frequently. Investors who relied on historical data as a reliable guide now face the challenge of interpreting signals in environments that behave differently from the past. As a result, flexible planning has become a necessity. Scenario based strategies help decision makers prepare for multiple outcomes rather than depending on a single prediction. This approach does not eliminate uncertainty but creates a buffer against its impact.

Reward Still Exists, but It Requires Strategy

Even in volatile markets, opportunities continue to emerge. The pace of innovation has opened pathways that did not exist a decade ago. Companies investing in automation and artificial intelligence are discovering new ways to reduce costs and improve efficiency. Cloud based technology allows small and mid sized companies to operate globally with ease. These advancements reward organizations that are willing to upgrade their systems and rethink traditional practices.

Investors, too, can find meaningful value by focusing on long term potential rather than reacting to daily fluctuations. Industries such as renewable energy, digital services, healthcare technology and advanced manufacturing offer powerful growth trajectories. These sectors benefit from global demand, policy support and behavioral shifts that are unlikely to reverse. The challenge for investors is to separate hype from genuine structural opportunity, which requires research and discipline.

For households, strategic planning can create reward even during difficult periods. Many individuals are turning toward upskilling and digital learning platforms to increase earning potential. Side income opportunities and small scale investing help build financial stability over time. While these steps involve effort and patience, they form a foundation that can withstand economic shifts.

Market Trend Insight

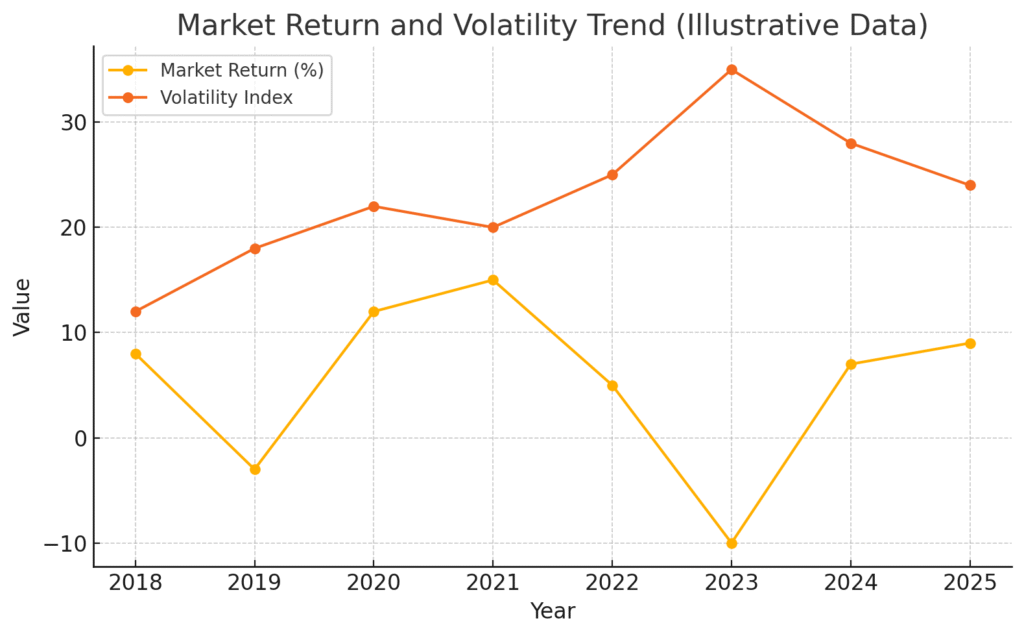

The following chart highlights how market returns often fluctuate in response to changes in volatility.

This visual helps underscore the need for consistent evaluation of risk and the importance of adaptable planning.

Periods with higher volatility often coincide with weaker returns or unpredictable swings. For investors and businesses, this data reinforces a valuable principle: strategy should never be based solely on momentum. It must include awareness of market conditions, potential turning points and broader economic signals.

Key Factors Shaping Risk and Reward

Effective decision making requires an understanding of the forces currently shaping both risk and opportunity. These include market behavior, technology trends, resource dynamics, corporate strategy and household conditions.

| Category | Rising Risk Drivers | Potential Reward Opportunities |

|---|---|---|

| Markets | Inflation pressure, unstable interest rates and rapid shifts in investor sentiment | Sector rotations, rebound cycles and undervalued assets |

| Technology | Fast disruption, cybersecurity threats and short innovation lifecycles | AI growth, automation efficiency and large scale digital expansion |

| Energy & Resources | Unpredictable pricing, supply constraints and geopolitical tension | Renewable energy progress, storage solutions and growing green investment |

| Business Strategy | Labor shortages, supply chain fragility and rising operational costs | New market entry, competitive innovation and operational redesign |

| Households | Higher living costs, credit tightening and employment uncertainty | Skill development, diversified income and long term investment growth |

Each category presents both challenges and openings. The ability to read these signals determines how well individuals and organizations position themselves for the future.

The Human Side of Economic Decision Making

Numbers reveal trends, but decisions are influenced by human behavior. Emotional responses often shape how people act during uncertain periods. Some individuals or organizations become overly cautious, delaying important decisions out of fear of making mistakes. Others take excessive risks, believing bold moves will guarantee greater reward.

The most sustainable approach blends awareness with confidence. People and companies who gather information, analyze trends and prepare for multiple outcomes tend to make better decisions. Clear communication within businesses reduces panic among teams and helps maintain direction. At a household level, discussing financial goals openly leads to more grounded and constructive choices. Understanding the psychological side of risk enables better long term outcomes.

How Businesses Are Adapting

Businesses are rethinking every layer of strategy in response to modern volatility. Supply chains, once optimized for cost efficiency, are being redesigned for resilience. Companies now work with multiple suppliers, distribute production across regions and build smarter inventory systems. These actions require investment, but they protect operations from sudden disruptions.

Financial management strategies are also changing. With borrowing costs rising, many organizations focus on strengthening balance sheets, improving cash flow and reducing unnecessary expenses. Firms are cautious about expansion but pursue opportunities that align with long term trends. Investment in talent development has increased as well. Employees capable of adapting to new technologies, learning quickly and navigating uncertainty are becoming essential to business growth.

Meanwhile, digital transformation is no longer a luxury. Businesses that adopt cloud systems, automation and data driven tools gain efficiency and improve their competitive position. These technologies allow them to respond faster to market shifts and deliver better services to consumers.

Investor Behavior in a Volatile Environment

Investors today face the challenge of balancing long term growth potential with short term instability. Many are broadening their portfolios across different markets and asset classes to reduce concentration risk. Diversification, once considered a basic principle, has become a more sophisticated practice that includes sustainable investments, international exposure and alternative instruments.

Risk adjusted thinking is becoming central to modern investing. Younger investors seek opportunity in emerging technologies and innovative sectors. Older investors prioritize safety and predictable income. Regardless of age, there is a growing recognition that informed decision making reduces vulnerability to sudden downturns.

Another key trend is the rise of self education. Investors today have access to tools and information that were once available only to professionals. This helps them understand market behavior more deeply and make decisions based on strategy rather than emotion.

Household Financial Adjustments

Households are adapting to higher living costs and greater financial pressure. Many families are prioritizing financial safety by building larger emergency funds and reducing unnecessary expenses. Budgeting has become more precise as people track spending more carefully.

Skill development has become a priority for working adults seeking higher income or career stability. Online learning platforms offer practical opportunities for growth, whether in digital skills, professional training or entrepreneurial development. Households also see long term investing as a means to build wealth gradually, even in small amounts. These actions help create stability during uncertain times and support long range financial goals.

Adaptability: The Essential Skill

Adaptability is no longer optional. It is the foundation of successful economic navigation. Individuals who can shift plans, respond thoughtfully to new information and stay flexible tend to perform better over time. Businesses that encourage innovation and adopt responsive structures are better equipped to manage challenges. Investors who remain patient and strategic overcome short term noise to achieve long term reward.

Adaptability does not mean constant change. It means having the readiness to change when needed. This readiness creates resilience against uncertainty and opens space for new opportunity.

Balancing risk and reward in today’s economy requires awareness, flexibility and purposeful strategy. While volatility creates challenges, it also reveals opportunities for growth and innovation. Businesses, investors and households can succeed by understanding the forces shaping the economy, preparing for multiple scenarios and making informed decisions. With a balanced approach, it is possible to navigate uncertainty with confidence and capture meaningful long term reward.