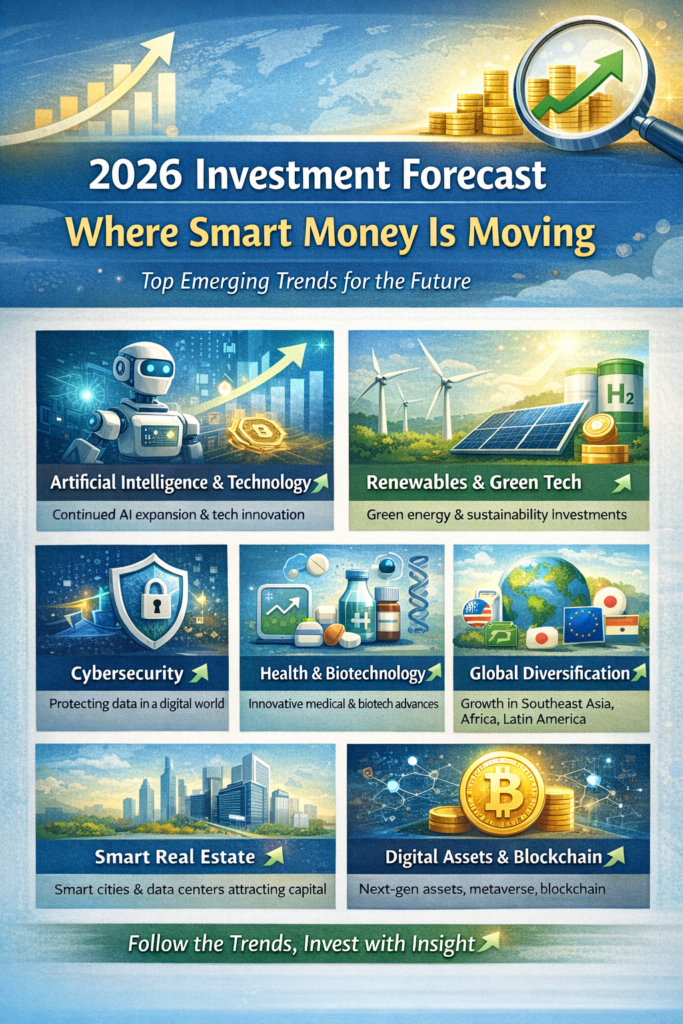

As global markets evolve, 2026 is shaping up to be a defining year for strategic investors. Economic shifts, technological acceleration, and changing consumer behavior are influencing where capital flows. Smart money is no longer chasing short-term gains. Instead, it is moving toward sectors that combine innovation, resilience, and sustainable growth. This investment forecast highlights the key areas attracting attention and explains why they matter in the year ahead.

Artificial Intelligence and Advanced Technology

Artificial intelligence continues to dominate investment conversations, and its influence is expected to deepen in 2026.

AI is no longer limited to big tech companies. It is now embedded across industries such as finance, healthcare, manufacturing, and retail. Investors are focusing on companies that build AI infrastructure, develop automation software, manage data systems, and enhance cloud computing capabilities.

Beyond AI itself, supporting technologies such as semiconductors, edge computing, and intelligent analytics platforms are also seeing strong capital inflows. These technologies are viewed as long-term growth engines rather than short-term trends.

Clean Energy and Sustainable Investments

Sustainability is becoming a core investment strategy rather than a niche interest.

Governments, corporations, and consumers are accelerating the shift toward cleaner energy sources. Solar power, wind energy, battery storage, and electric mobility are attracting consistent investment as the world moves toward lower carbon solutions.

Green finance tools such as sustainable funds and climate-focused portfolios are also gaining popularity. Investors see clean energy as both a growth opportunity and a way to reduce long-term environmental and regulatory risks.

Cybersecurity as a High-Priority Sector

As digital adoption increases, cybersecurity has become essential rather than optional.

Companies and institutions are investing heavily in protecting data, systems, and digital identities. This has made cybersecurity one of the most resilient and attractive sectors going into 2026.

Smart money is targeting businesses that provide advanced threat detection, cloud security, identity management, and AI-driven protection systems. With cyber risks rising globally, demand for these solutions is expected to remain strong.

Healthcare and Biotechnology Innovation

Healthcare continues to attract long-term investors due to demographic shifts and technological breakthroughs.

An aging global population, combined with advances in medical technology, is driving growth in biotech and health innovation. Areas such as personalized medicine, gene therapy, digital diagnostics, and AI-assisted drug development are drawing investor attention.

Healthcare technology companies that improve efficiency, reduce costs, or enhance patient outcomes are viewed as strong candidates for sustained growth in 2026 and beyond.

Real Estate Evolution and Infrastructure Assets

Traditional real estate investing is changing, and smart money is adapting.

Instead of focusing solely on residential or commercial properties, investors are shifting toward infrastructure-driven assets. Data centers, logistics hubs, and technology-enabled properties are gaining momentum as digital services expand.

Sustainable buildings and smart city developments are also becoming attractive due to energy efficiency, long-term demand, and regulatory support.

Emerging Markets and Global Diversification

Global diversification is a key theme for 2026.

Investors are increasingly exploring opportunities outside established markets. Emerging economies are showing strong growth in technology adoption, renewable energy, financial services, and digital commerce.

By spreading investments across regions, smart investors aim to reduce risk while capturing higher growth potential. International exposure is no longer optional for those seeking balanced portfolios.

Alternative Assets and Digital Economy Growth

Alternative investments are gaining traction as investors look beyond traditional asset classes.

Digital assets, blockchain-based platforms, and tokenized investment models are evolving into more structured and regulated opportunities. While these assets remain volatile, selective exposure is becoming part of modern portfolio strategies.

Other alternatives such as private equity, infrastructure funds, and innovation-focused ventures are also attracting capital from forward-thinking investors.

Conclusion: Investing Smart in 2026

The 2026 investment landscape favors thoughtful, future-focused strategies over speculation.

Smart money is moving toward sectors that align with long-term global trends like technology integration, sustainability, healthcare innovation, and digital security. Investors who focus on diversification, quality assets, and structural growth drivers are better positioned to navigate uncertainty and capture opportunity.

The key to success in 2026 is not chasing hype, but investing with clarity, patience, and a forward-looking mindset.